Are financial planning and investment advisory services the latest profession to fall prey to computer automation, as is in the case of Robo Advisors? Robo Advisors like Betterment, WealthFront, Jemstep, WiseBanyan, Blooom and Motif, all claim to do more for less through a process of self diagnosis utilizing a battery of financial questions that you answer through your computer, tablet or cell phone. Imagine, all while you could be monitoring your heart rate and calorie burn with your own personal electronic device that is keeping you in touch. Sounds incredible and it is, for the most part.

How do you determine when you are better off with a financial advisory relationship with a person not a computer? My contention is the amount to be managed and the intended length of time for the advisory relationship is a good place to start. If you have at least $500,000 and you desire a financial advisory relationship to last for as long as the relationship meets your long term financial goals, then you need and deserve a financial advisory relationship with a person not a computer.

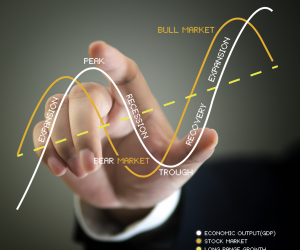

Robo Advisors’ contribution to the investing public is to have commoditization of online investment management platforms that automate, through Monte Carlo simulations, asset allocation models that provide projected outcomes based expected returns and portfolio volatility. From these statistical calculations, investors are provided with the most likely outcomes for their investment portfolio. Next, most Robo Advisors explain how much “better off” they are with this new direction, through the calculation of the “Alpha”. In Modern Portfolio Theory terms, Alpha is the investment return an investor achieved above or below what they should have achieved based on the amount of risk they assumed. For instance, an investment portfolio with an Alpha of 2.0 means the annual rate of return achieved by the investment manager was 2.0% greater that should have been achieved, given a given time period. It is important to understand that all of the calculations are based on historical data! Figuratively speaking, Robo Advisors help you drive your investments “car” looking through the rear view mirror.

Let me be clear, Monte Carlo simulations are widely used by financial planning practitioners to project expected future outcomes for recommended investment portfolios based on asset allocation models and the portfolio Alpha is referred to as a measure of “expected benefit”. What other types of Alpha-driven advice can a competent, professional financial advisor provide you? A financial advisor can provide improvement in your tax-Alpha, estate-Alpha, insured risk-Alpha and longevity-Alpha, and more, such as peace of mind and better understanding.

True North Financial Advisors, located in Boca Raton, Florida provides personalized financial planning and investment advisory services through personalized attention. To help with a personalized financial planning experience we provide a web based platform through eMoney Advisor® which is extremely easy for clients to upload and organize their financial information on their own personalized financial website — largely without any assistance. To learn more go to our video library.